Introduction

Trend Day Trader Mini is a free Expert Advisor designed for traders seeking a simplified yet effective approach to trading in the Forex market. It is particularly suitable for beginners due to its straightforward strategy and easy setup.

Features

Trend Following Strategy: Trend Day Trader Mini employs a trend-following strategy, making it ideal for capturing trending market movements.

User-Friendly Setup: The Expert Advisor is designed to be easy to install and configure, making it accessible to traders of all experience levels.

Flexible Timeframes: Trend Day Trader Mini can be used across various timeframes, offering versatility to match your trading preferences.

Customizable Parameters: Tailor the strategy to your trading style with customizable parameters, such as timeframe, stop loss, take profit levels, and more.

Comprehensive Documentation and Support: Detailed documentation accompanies Trend Day Trader Mini, providing clear instructions for setup and configuration. Additionally, a dedicated support team is available to assist with any queries.

Using Trend Day Trader Mini

To effectively utilize Trend Day Trader Mini, follow these steps:

Installation: Install the Expert Advisor onto your MetaTrader 5 platform.

Configuration: Adjust the Expert Advisor settings to align with your trading preferences.

Begin Trading: Initiate trading using the configured settings.

The Trend Following Strategy

Trend Day Trader Mini employs a straightforward trend following strategy rooted in Elliott wave theory. This theory, developed by Ralph Nelson Elliott in the 1930s, proposes that market cycles can be analyzed and divided into waves, including smaller waves within them.

The Expert Advisor executes trades by capitalizing on breakouts from consolidations on the daily timeframe. When the price escapes a period of consolidation on the daily chart, the Expert Advisor enters a trade.

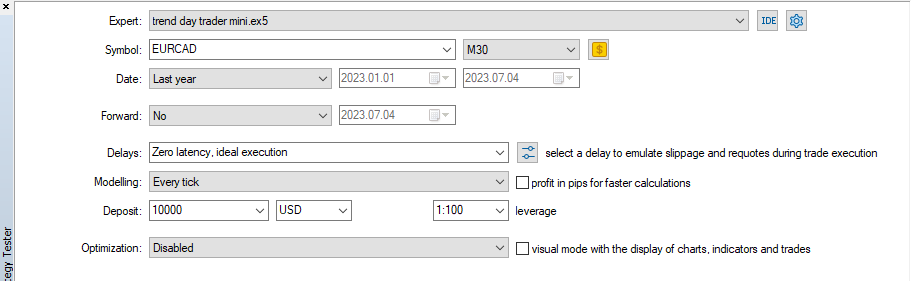

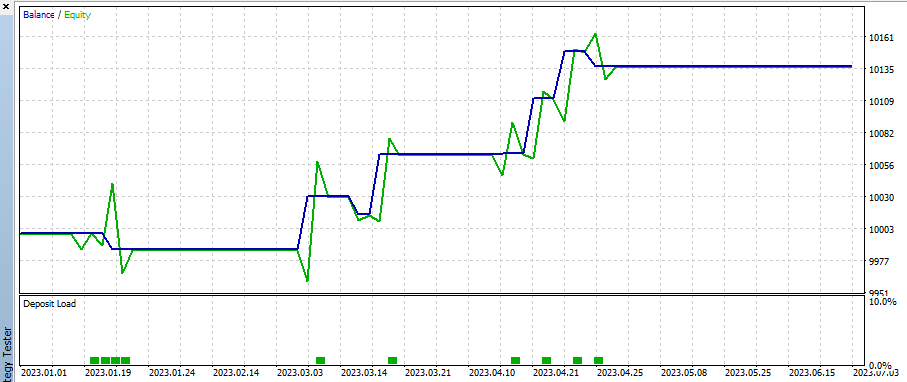

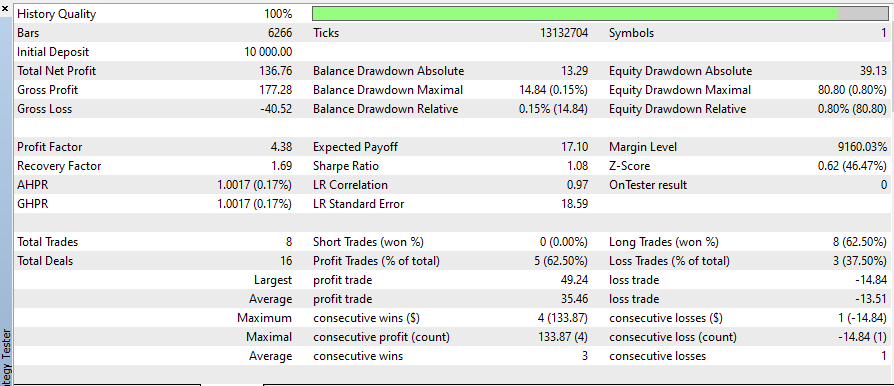

Backtesting and Optimization

Leverage the backtesting feature to test Trend Day Trader Mini on historical data, gaining insight into its past performance. Optimization capabilities allow you to fine-tune strategy parameters for enhanced effectiveness.

Customizable Parameters

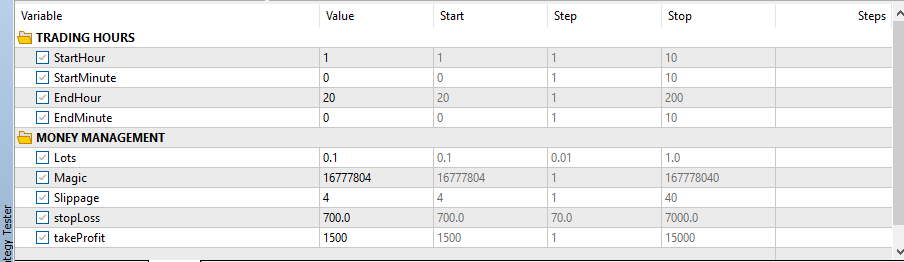

Tailor Trend Day Trader Mini's strategy to suit your trading approach with customizable parameters. Adjust the timeframe, stop loss, take profit levels, and the number of waves to monitor.

Comprehensive Documentation and Support

Trend Day Trader Mini is accompanied by thorough documentation explaining strategy usage and Expert Advisor configuration. A responsive support team is on hand to address any inquiries you may have.

Conclusion

Trend Day Trader Mini offers an uncomplicated yet powerful solution for traders, particularly those new to the market. Clear documentation and reliable support facilitate easy strategy comprehension. The inclusion of backtesting and optimization features allows you to adapt the strategy to your unique trading style.

Additional Information

Weekly Timeframe Consideration: Avoid trading when the price is consolidating on the weekly timeframe, as the strategy primarily focuses on daily timeframe breakouts.

Market Type Suitability: Trend Day Trader Mini is designed for trending markets and may not perform optimally in range-bound conditions.

Customization Potential: Adapt the Expert Advisor to different timeframes and assets as per your trading preferences.

Performance Enhancement: Maximize strategy effectiveness using backtesting and optimization features.

Support and Learning: Utilize the comprehensive documentation and available support for learning, troubleshooting, and strategy refinement.

USD/CAD H1

stoploss: 400

takeprofit: 600

EUR/CAD H1stoploss: 550

takeprofit: 800

AUD/USD H1stoploss: 250

takeprofit: 600

GBP/JPY H1stoploss: 700

takeprofit: 900

GBP/USD H1stoploss: 450

takeprofit: 600

USD/JPY H1stoploss: 200

takeprofit: 700

GBP/CHF H1stoploss: 350

takeprofit: 600

EUR/USD H1stoploss: 300

takeprofit: 500

USD/CHF H1stoploss: 250

takeprofit: 800

CAD/JPY H1stoploss: 250

takeprofit: 400

CHF/JPY H1stoploss: 300

takeprofit: 700

EUR/JPY H1

stoploss: 300

takeprofit: 900

EUR/AUD H1stoploss: 400

takeprofit: 1400

GBP/NZD H1stoploss: 1000

takeprofit: 1000

GBP/AUD H1stoploss: 1000

takeprofit: 700

GBP/CAD H1stoploss: 500

takeprofit: 550