The Spurt bot implements the maximum of the HFT definitions. The expert system goes through the entire history and all currency pairs with a single setting. If there is a commission on the account, it must be converted into the spread equivalent and fill in the Commission field. Both virtual and real stop losses are used.

The Spurt bot implements the maximum of the HFT definitions. The expert system goes through the entire history and all currency pairs with a single setting. If there is a commission on the account, it must be converted into the spread equivalent and fill in the Commission field. Both virtual and real stop losses are used.

Conditions for normal operation:

- The smaller the commission and spread, the greater the profit.

- The more delay your broker has in total with the Internet channel, the larger you need to set stops so that the server has time to process them at the right price and the lower the trading frequency will be.

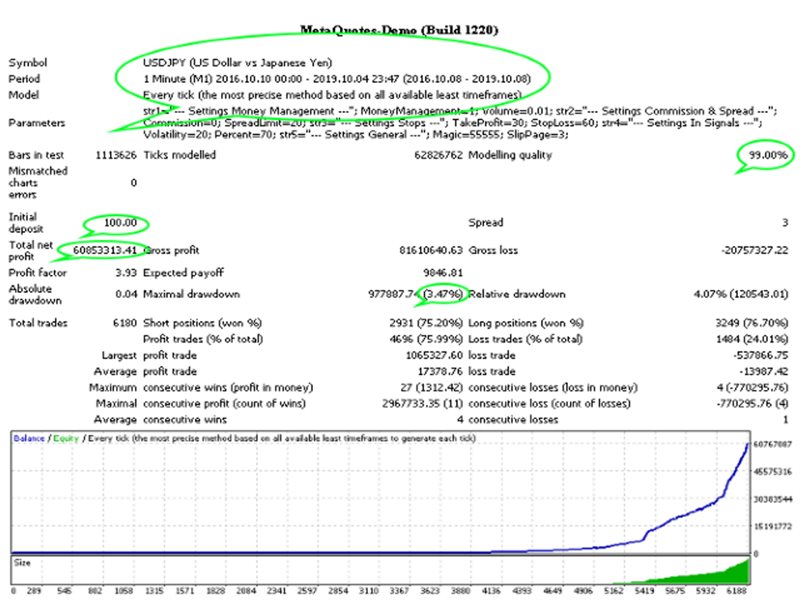

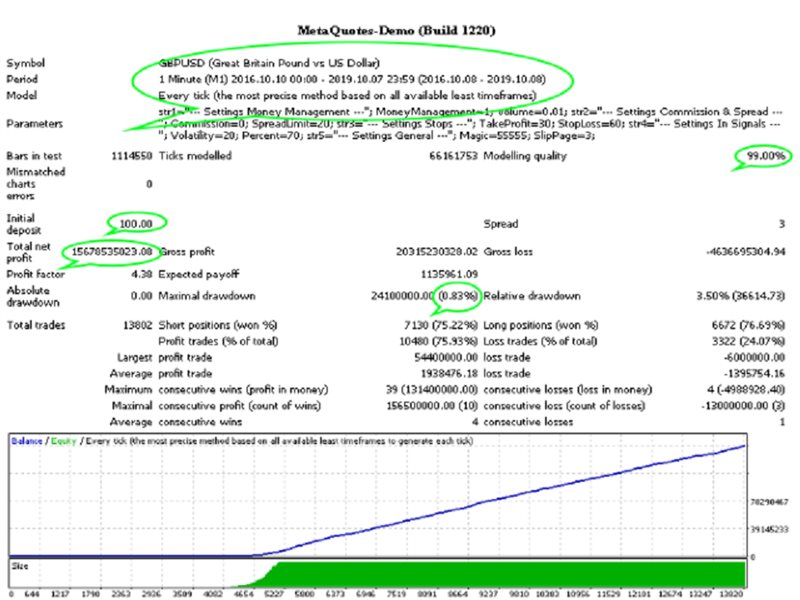

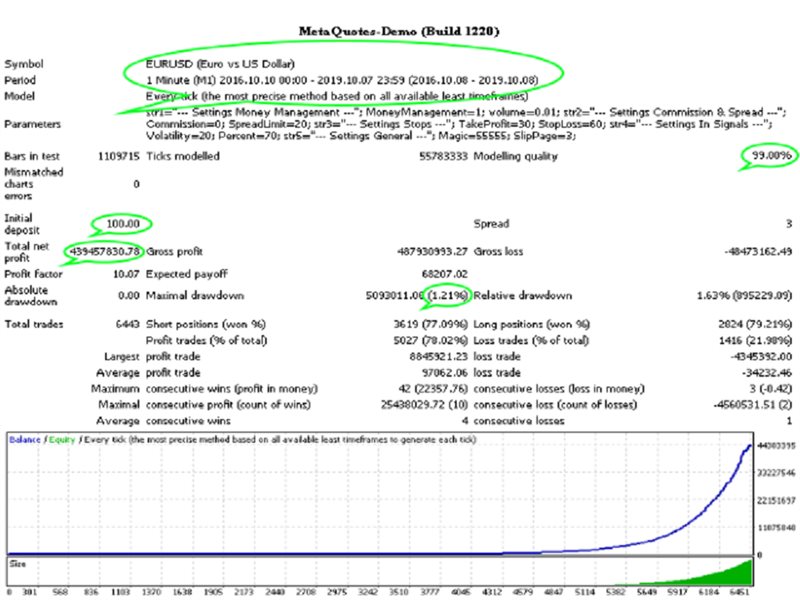

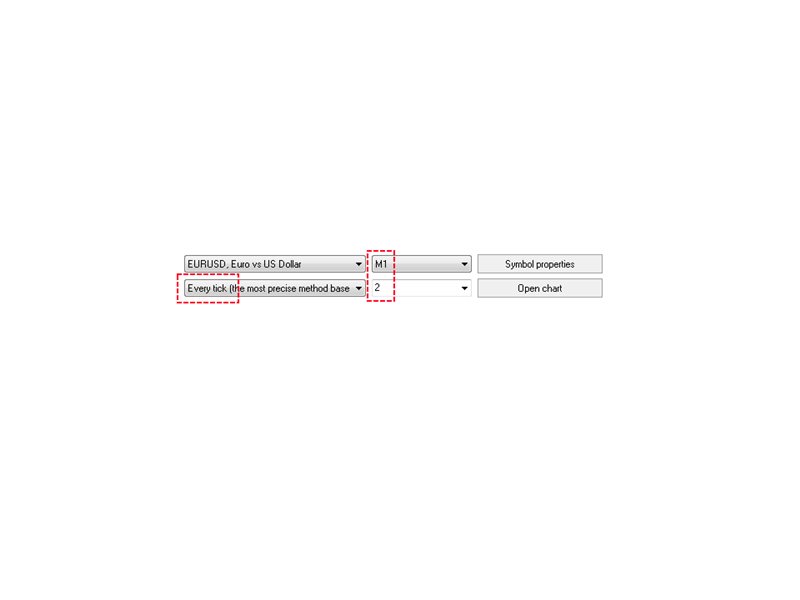

- When testing, the spread can be adjusted and only all ticks can be used!

- You can start using the bot with 100$ and 0.01 lot.

High-frequency trading has nothing to do with traditional trading.HFT is a technological form of completely legally permitted “criminal insider trading” that creates an advantage for some market participants over others.The basis of HFT is the so-called flash orders, high-speed exchange orders of execution will depend on the mathematical algorithm of the robot embedded in the HFT.

Fundamental to HFT trading are speed, secret technologies and algorithmic trading. HFT trading combines many trading strategies, latency arbitrage, index arbitrage, currency arbitrage, volant arbitrage, statistical arbitrage and merger arbitrage, as well as global macro, long/short capital, passive market creation and so on.

HFT traders rely on the ultra-fast speed of computer software, access to high speed data links, critical resources and low latency connectivity.

With access to a high-speed computer and the Internet, you can use this product. Other attempts to use the product on a low-speed computer and Internet channel will not give a successful result. To what extent an expert is high-frequency can only be determined by you, taking into account all of the above.

Bot properties:

- MoneyManagement - the volume is calculated from the size of the deposit.

- volume - fixed volume for work.

- Commission — you need to pick it up by recalculating the commission for pips and set the indicator in pips as an addition to the spread.

- SpreadLimit — spread limit.

- TakeProfit — take profit in pips.

- StopLoss — stop loss in pips.

- Volatility - the parameter allows you to place an order only if the volatility is higher than this relative parameter.

- Percent - the ratio of real volatility to the given one, in percent.

- Magic - magic number.

- SlipPage — maximum slippage level.