MT5-Trending Ornstein Uhlenbeck Slope Bands

¥2,021.00

- Brand: LANCOME

- Product Code:

- Availability: In Stock

General

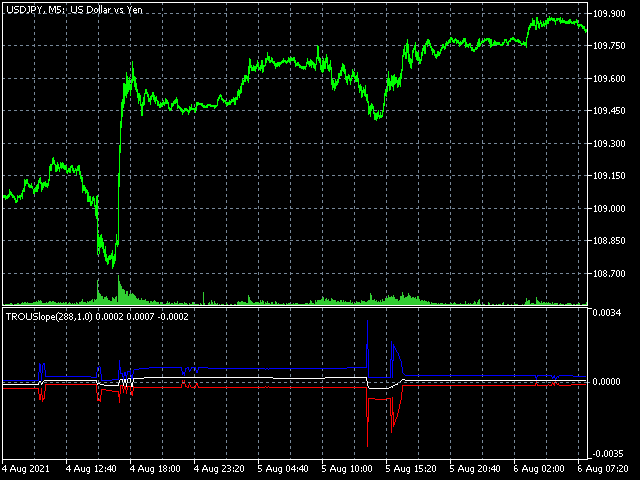

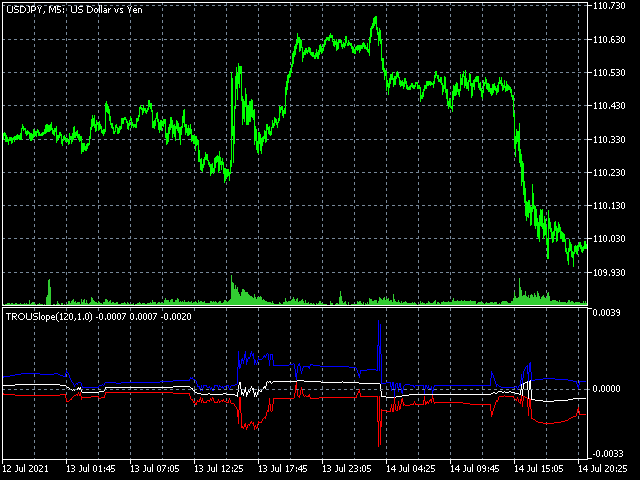

The Ornstein-Uhlenbeck process is one of the most important processes defined by a stochastic differential equation. It is used both in the natural sciences and in financial mathematics. The trending Ornstein-Uhlenbeck process is an advancement of the Ornstein-Uhlenbeck process. The difference is similar to the difference of the Bollinger Bands and the Linear Regression Bands. Assuming that the stock market price follows an trending Ornstein-Uhlenbeck process, this indicator determines the fair slope and the standard deviation of this, which is displayed as bands around the fair slope. This should make it possible to determine the significance of a trend.

Parameters

- Period: The number of values (e.g. bars) that should be used to calculate the fair price.

- Width: Multiplier for the width of the bands of fuzziness.

- MaxDeviationFactor: Specifies how high the deviation of the determined fair price from the current price is allowed to be measured against the standard deviation.

Explanations

Since overestimation of market movements can occur when calculating the fair slope, which leads to strong fluctuations of the calculated fair slope and increased fuzziness, the MaxDeviationFactor parameter was introduced. It should not be set too low, so that justified deviations of the slope are not suppressed.IIf the assumptions underlying the model are not fulfilled, the displayed standard deviation of the slope may be zero. In such a case, the displayed values are not meaningful.

Ideas

Of course, everyone can make up his own mind what to do with an indicator. But here I would like to pass on a simple trading idea, namely the trend idea: if the lower band is above zero and no trend reversal from an upward to a downward trend can be seen, then this can be seen as a buy signal.