EA Smart Grid

This EA is based on functions and algorithms rarely used by other programmers.

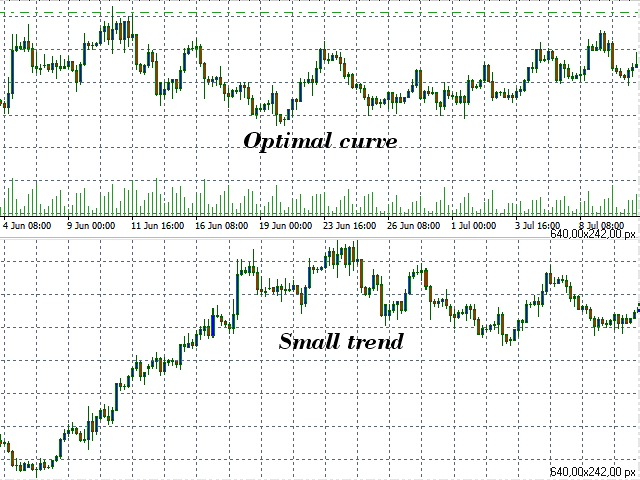

Can work on all crosses.

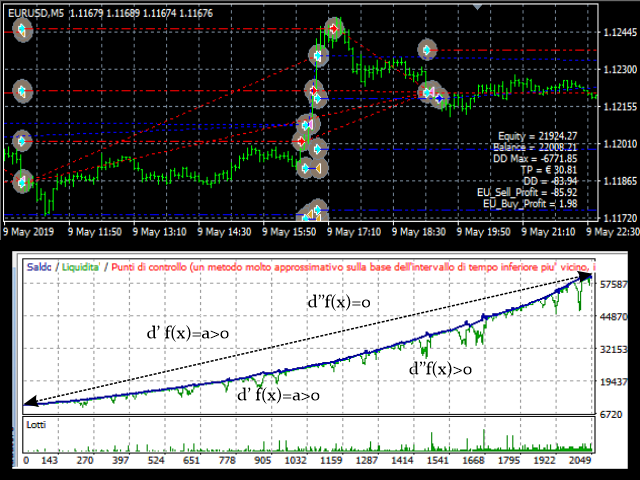

It derives from advanced mathematical calculations that vary parameters and variables in an "intelligent" way. At each closing of the short or long position, the functions readjust almost all the values to the new balance sheet, margin, equity situation.

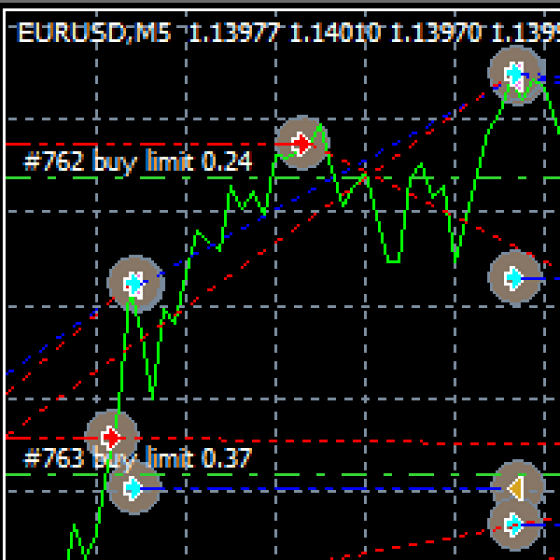

First of all I want to clarify that it does not use any indicators. Instead, it is based on a non-proportional or fixed progression of the network steps, of the invested volumes, of the fixed stop losses. There is a constant specification that applied to the basic settings (and distributed among balance sheet values, lots, number of open positions, drawdown and margin level), allows the computer robot to ALWAYS recover the losing positions by closing the operation with profit. With the help of some screenshots I will try to briefly explain how I can achieve these results by making my EA a computer robot with capabilities close to artificial intelligence.

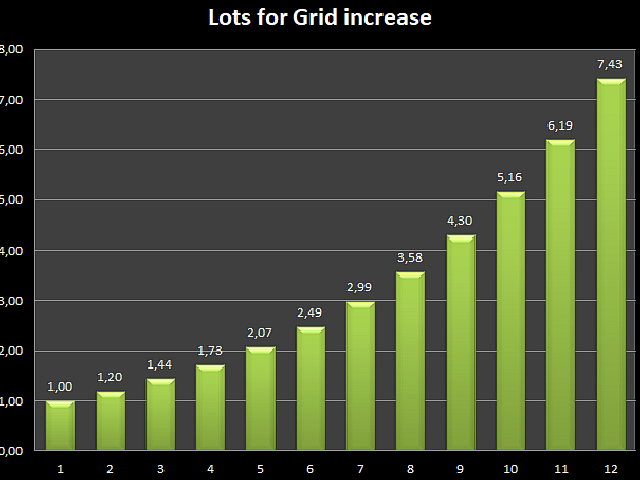

I want to clarify that my EA is not a "Martingale".

The product between increasing the batch volume and increasing the grid pitch is always less than 2.

However, my EA doesn't fall into the fatal mistake of the "default" martingale (which is always possible), as it provides 2 types of StopLoss:

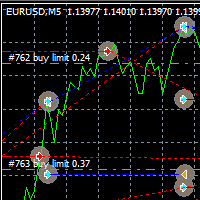

1. At a predefined DrawDown I begin to close, in the losing position furthest from the price, 0.01 “microlot” lots to slightly decrease the DD, increase the margin and reduce the rebound necessary to close the positive positions.

If the entire operation with “microlots” is closed, it will be replaced immediately by a new operation positioned, however, in a much more advantageous position and in addition by an OrderSend limit.

2. At a certain number of positions opened at a loss, the furthest position closes completely obtaining the same result as above in a faster way.

With the default settings it is possible to cover the total width about 7000 points (for example from 1.12000 to 1.19000)!

In conclusion, in the end it happens every time the Sell goes into drawdown, the Buy collects the takeprofit and in the opposite direction the same thing happens. Also, at the slightest bounce, the sale closes in profit.

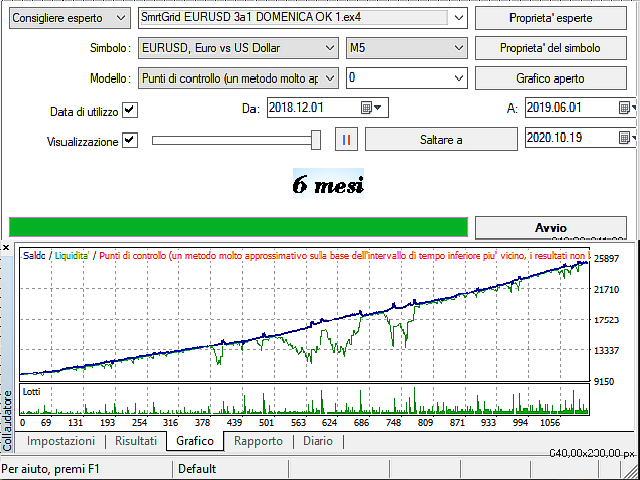

Finally, it should be noted that the gain is not proportional, but slightly exponential. This can be seen in the average profit of 220% in the semester and 550% per annum.

I also recommend using the software on a cross with a minimum spred.