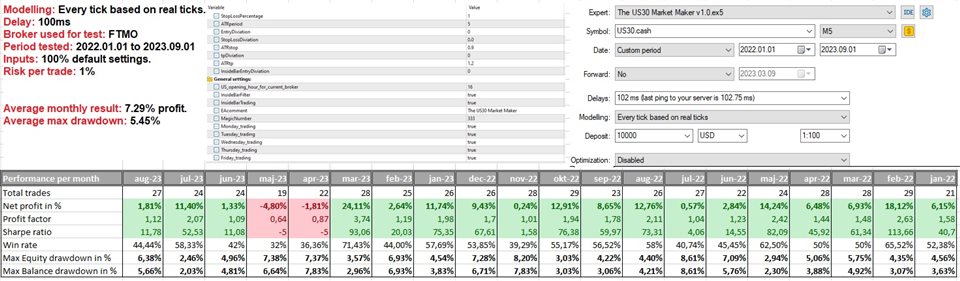

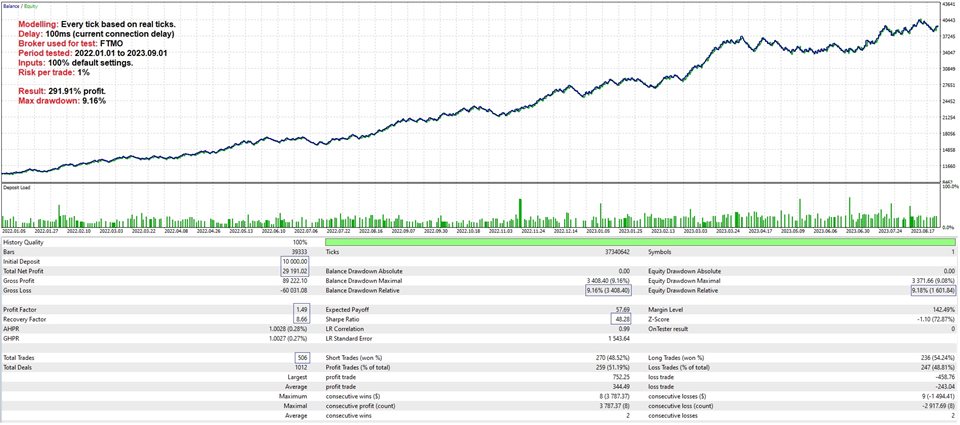

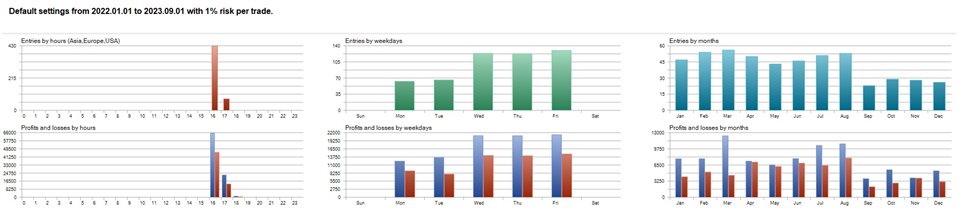

The Dow Jones index, also known as the US30, is a very well diversified index with a unique way of weighting it’s components. These factors often make this index’s open a bit more rangebound, so instead of trading breakouts, The US30 Market Maker uses limit orders and stop-limit orders to trade the opening range. Both take-profit and stop-loss is based on current volatility, and the EA does NOT use martingale, grid systems, hedging or other types of risky money management tactics! I have traded the strategy manually for over a year now and it has performed well, so I decided to automate it and share it with the MQL5 community.

IMPORTANT recommendations:

Testing: You should ALWAYS download the demo and do some testing on your own broker before buying ANY EA on the MQL5 market. You can watch the video below for information on how to test the EA correctly or contact me on here if you have any questions.

Set files: Set files for the default input settings can be found in the comment section.

Risk: If you’re using the default settings, I’d recommend anything from 0.2% to 3.5% risk per trade. Depending on how aggressive you want to trade.

Market: Should only be used on the US30.

Timeframe: The strategy uses the 5 min timeframe, but it will still work just as well if you have your chart set to another timeframe.

Minimum deposit: $500.

Account type : Preferably ECN, raw or Razor with low spreads.

Brokers: I’d recommend ICMarkets, Pepperstone or any other reputable broker that offers low spreads and good executions. For prop trading I’d recommend FTMO. The EA works on all brokers though!

MT5 account type: Preferably Hedge.

Detailed explanation of strategy inputs:

StopLossPercentage = Here you decide how many percent of your account balance you’re willing to risk on every trade.

ATRperiod = The ATR indicator is used to help with the volatility calculations so here you can change the ATR length if you want to.

EntryDiviation = This input decides how much the market must go above/below the range in order to trigger the pending order.

StopLossDiviation = You can use this input to fine-tune the stop loss a bit if you want to.

ATRstop = This input determines how big the stop loss should be in terms of the current ATR(5) value.

tpDiviation = You can use this input to fine-tine the take-profit a bit if you want to.

ATRtp = This input determines how big the take-profit should be in terms of the current ATR(5) value.

InsideBarEntryDiviation = This input decides how much the market must go above/below the inside bar in order to trigger the pending order.

US_opening_hour_for_current_broker = The hour of the day where the US stock market opens based on your broker’s time. The broker’s time is the time you see on your chart. The US stock market opens at 09:30am New York time, so use that for reference.

InsideBarFilter = This input decides whether the EA applies the inside bar filter. The inside bar filter makes the EA deal with inside bars around the open in a more effective manner.

InsideBarTrading = This input gives the EA the green light to place orders around the inside bar’s range on top of the normal opening range orders.

EAcomment = A unique comment for the EA so you can easily identify the trades taken by the EA.

Magicnumber = This is just an EA identification number, but you should make sure that this number is unique from any other EAs you’re using!

If you have any questions about the strategy or how to test it, please feel free to send me a message on here!