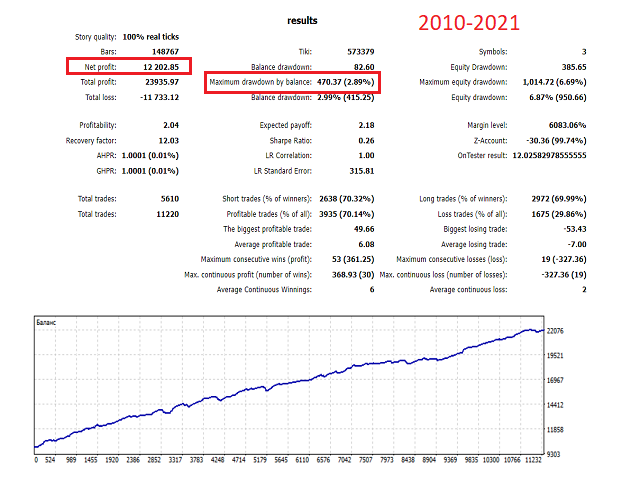

The tuning, the search for the optimal patterns of the robot was carried out on the history from 2010 to 2021.

The tuning, the search for the optimal patterns of the robot was carried out on the history from 2010 to 2021.Mt5 version https://www.mql5.com/ru/market/product/76037?source=Site +Profile+Seller

Here you can check the work of the multicurrency option in the tester

The parameters of the pairs are set from the best options, so it is not recommended to change anything, although there is such an opportunity.

Description of parameters:

List pair for trade - selection of pairs on which the advisor will tradeSuffix broker - if the broker has a suffix in the names of pairs - enter itStart Lot - initial lotDepo Per Lot (to аll sets) - allows you to increase the lot together with the depositMax Trade Pairs (0-off) - the maximum possible number of pairs simultaneously tradingStop Equal Currency Trading - closing and stopping tradesMax Drawdown filter,% (0-off) - maximum drawdown controlMinimum deposit - 500 USD, recommended 2,000 USD per 0.01 lot of the basketSets_variant - set variant

- The advantages of inline mode:

- Universal parameters for several pairs, which does not fit the history.

- A small deposit is required, which gives the best profit with a compound interest.

Trading is based on calculating the channel of the average movement of a trading pair, and in case of a strong deviation from it, we trade for a return. The distribution of the entire position is based on signals from different time periods. Each position is closed when returning to its average values. With a very strong deviation, which happens very rarely, we strengthen our positions in order to take even more profits from the market.

Strengths:

- Diversification of EA instances:

The EA works on each pair in several instances with slightly different parameters. This is done so that each instance of the advisor enters and exits the market at a slightly different time. Why is this needed?

The search for the optimal parameters of any Expert Advisor is reduced to the construction of a multidimensional distribution function with the search for an extremum. Visually, in a two-dimensional dimension (when changing two parameters), the function looks like a graph of the Gaussian distribution ( https://ru.wikipedia.org/wiki/%D0%9D%D0%BE%D1%80%D0%BC%D0%B0 % D0% BB% D1% 8C% D0% BD% D0% BE% D0% B5_% D1% 80% D0% B0% D1% 81% D0% BF% D1% 80% D0% B5% D0% B4% D0 % B5% D0% BB% D0% B5% D0% BD% D0% B8% D0% B5)Where the vertical axis is the efficiency of the EA, the higher the vertical point, the better the EA parameters are matched. It is a mistake to assume that having found such a distribution function of the effectiveness of an advisor depending on the parameters, you need to use one pair of settings corresponding to the highest point of the distribution function.It is correct to use the set of points from the found optimal region in which the distribution function exceeds a certain threshold of efficiency.From the point of view of forex advisors, this means that almost always using multiple instances of an advisor with slightly different parameters is better than one instance of an advisor with parameters that the algorithmic trader considers “ideal”.

- Floating range of the order grid:

The EA uses a grid of orders, which is quite common for pullback trading systems. But the important point in calculating the price at which the next position will open is that there is no fixed level that the price must pass in order to open the next order. The price of the next order is calculated depending on the market volatility. If the volatility is high, then orders are opened less often. If the volatility is low, then orders are opened more often. Again, the EA looks at the market, and does not use hard-wired parameters.

The advantage of this trading strategy is that if you turn off all the frightening martingale, it still remains very profitable!