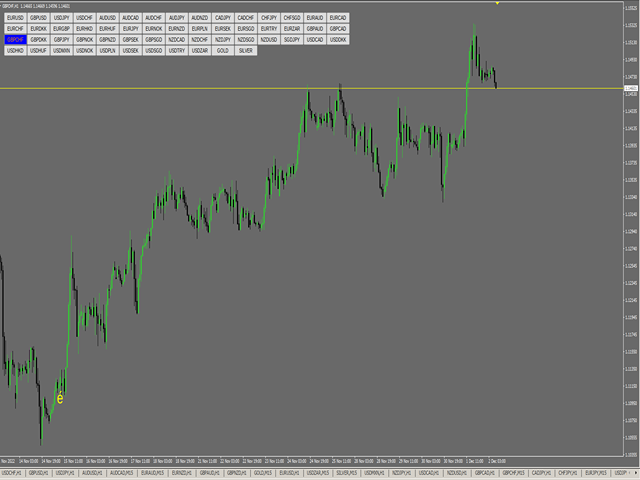

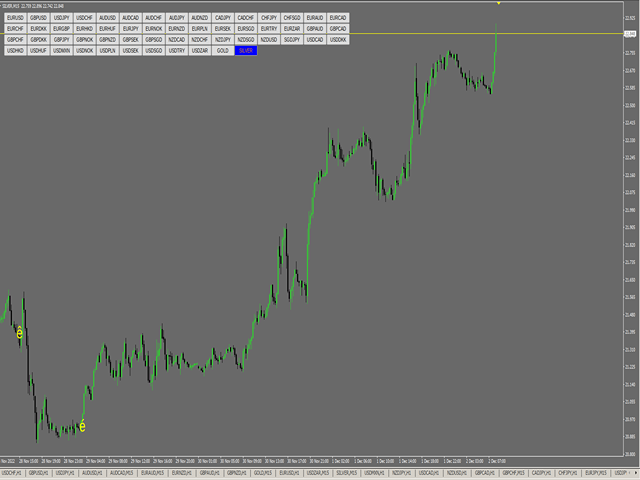

Profit from Mid Week market structure reversals

The market structure reversal alert indicator identifies when a trend or price move has approached exhaustion and ready to reverse for the week. It alerts you to changes in market structure which typically occur when a reversal or major pullback is about to happen. The indicator then alerts you to a potential shift in direction and the start of a possible reversal in trend or major pullback.

Gambino Arrow Indicator works perfectly on M15, H1 and Day time-frames. Expect up to 100 pips on M15, 300 pips on H1 and up to 1000pips on Day time-frame. Gambino Arrow Indicator can be used in EAs and works well. Sends notifications with TP and SL that you can set on your own. Gambino Arrow Indicator 's signals are 70-85% signals are right.

What is a Mid Week Reversal

The midweek reversal can happen on any day of the trading week and is a reversal of the dominant weekly trend after three levels of rise or fall. Now for example, once smart money has completed a weekly bull trend over the course of say two to three days; the midweek reversal we changed the direction to a better trend. We’ve seen three levels of rise, we go into level 3 accumulation, and then the market reverses, and we see three levels of fall and that is simply a reversal of the prior trend. Now the reversal is not guaranteed and is dependent on smart money’s fundamental outlook of the particular currency. Like with retail traders obviously smart money is going to be analyzed in particular currency pairs at any one moment in time and they’re going to have their opinion as to whether the pair is going to be bullish or bearish over the short term.

If we see three levels of rise and the fundamental outlook on the currency pair is bearish then out of level 3 accumulation smart money are going to accumulate sell orders. We’re going to see the manipulation of the retail orders to the upside inducing traders into the wrong side in a market. Smart money will sell into this, and we will see the midweek reversal as a bear trend unfolds.

On the flip side if we see three levels of fall and the fundamental outlook on the currency pair is bullish, then during the level 3 accumulation smart money are going to accumulate by orders induce sellers into the market buy into this pressure and then the midweek reversal will unfold in the form of a bull trend. So the fundamental outlook on a currency pair will determine whether we’re going to see the midweek reversal or if we’re going to see the continuation of the prior trend.

Now the midweek reversal offers a swing trade opportunity if the start of the midweek reversal can be identified and entered an intra-day trade blast in two to three days can be entered with a potential of 150 to 300 Pip gain. All this means is, if we can identify the midweek reversal and we looked at an example of this in terms of catching Phase 1 of a trend sell out of the level 3 accumulation, we’re going to identify manipulation to both sides of the market and our intention is to catch the midweek reversal or the trend continuation from phase 1.

Benefits of Gambino Arrow Indicator

- Unique Algorithm

- Predict Trends

- Time-frames: M15, H1 and Day

- Assets: All

- Easy to use, does not overload charts with unnecessary information

- Does not repaint

- Alerts on charts arrow appears.

- Excellent product support

For custom EA using Gambino Arrow Indicator , contact me with the details below:

I can give you settings, join my Telegram group on https://t.me/realoptimusea .