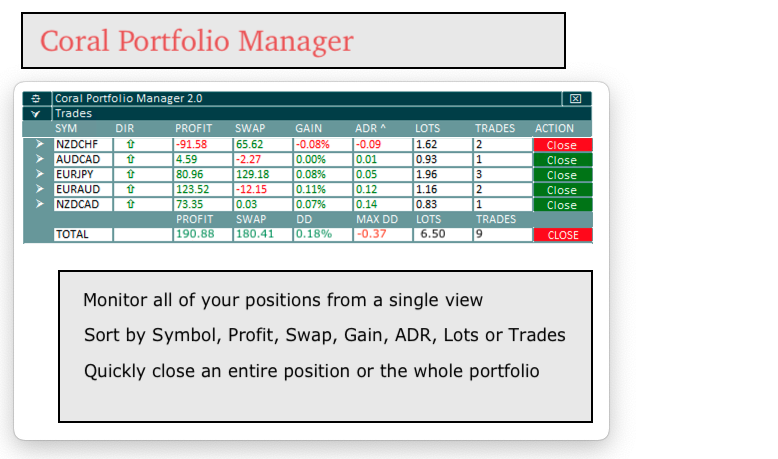

Coral Portfolio Manager provides a convenient way to monitor all of the positions in your portfolio, and to see the key information that you need to make decisions when position trading.

- Each row is a position: all of the trades on a symbol in the same direction (e.g., EURUSD long)

- Display the total profit, swap costs, gain %, ADR distance to average, number of trades

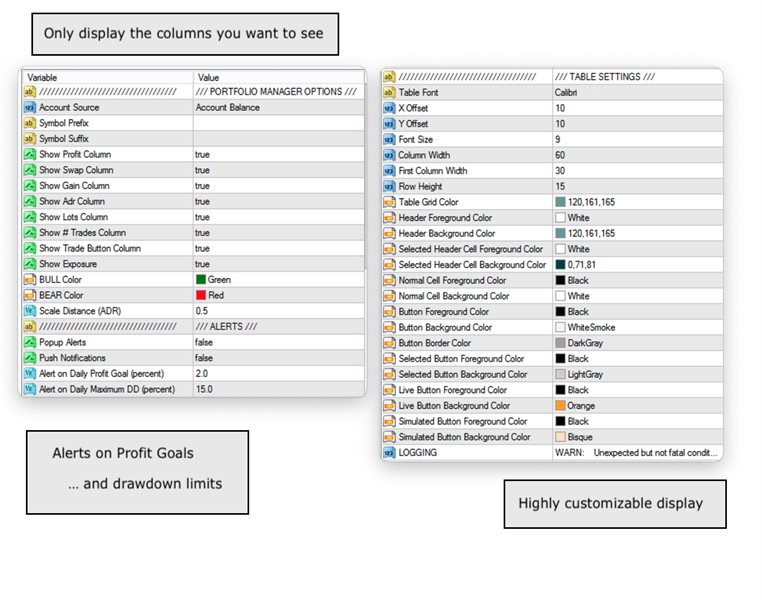

- Each column can be displayed or hidden

- Numeric columns can each be sorted ascending or descending

- Close button lets you close all trades in this position with a single click (well, 2 clicks, there is a confirmation dialog so you don't accidentally close anything)

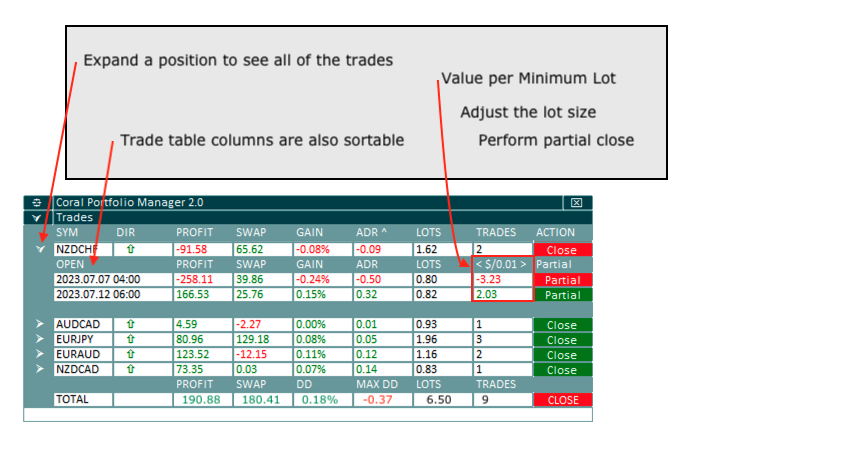

- Expand the position to see the individual trades

- Trades can also be sorted by their numeric columns

- Calculates the Value per Minimum Lot of this trade

- Set the number of lots to see the value for that trade size

- Perform a partial close of that number of lots right from the trade list

- Total row shows summary of all positions in the portfolio

- Close button lets you close all trades in the portfolio

- Monitor the total drawdown on your portfolio here

- The Symbol name can be clicked to open each position in a paired chart (the " External Chart "), to easily review all of the positions in your portfolio.

- The Exposure Row will display the exposure for each currency being traded in your portfolio

- Alerts will tell you when your portfolio exceeds a maximum drawdown limit, or when you have reached a target amount of profit for the day. Alerts are reset on each new day.

The trade profit includes commissions and swap costs. I mean, if the trade is $20 in profit and has $40 in swap costs, it's not really in profit, is it?

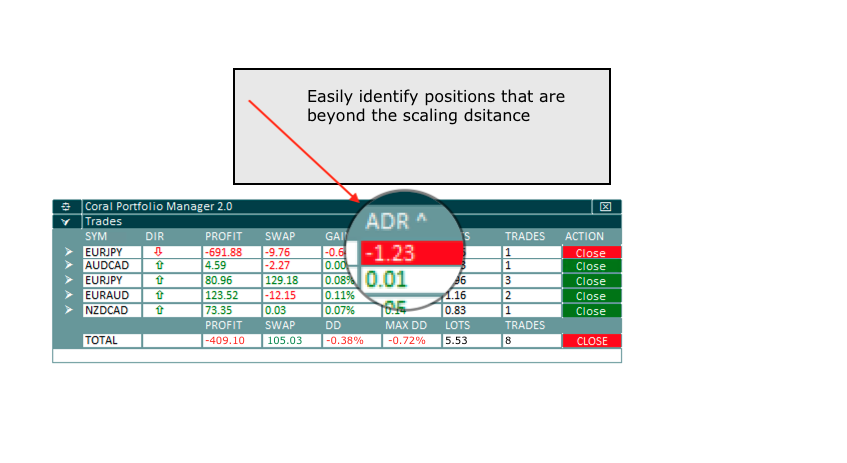

When position trading there are two common activities you need to perform that Coral PM is designed for: monitoring positions for when you need to scale in, and performing drawdown control.

- Scaling in - Typically you scale in when price exceeds a distance from the position average. The "ADR" column displays the distance to the position average, and will highlight positions that exceed the scaling distance. You can now monitor the distance from average for all of the positions in your portfolio from a single dashboard.

- Drawdown Control - In the sub-table for the trades in a position you can set the number of lots for any trade to see the value for that number of lots, and then close that number of lots right from the dashboard. Typically you would do this to a trade in drawdown when you have another trade in profit.

Coral Portfolio Manager , like the other products in the Coral suite of tools, can use the skins designed for the CoralMAX position trading EA (more info here ).

NOTE : Although Coral Position Manager was designed to be as efficient as possible, during periods of high volatility/volume and on slower systems it may become noticeably slower, e.g. taking a few seconds for the sub-table displaying all of the trades in a position to expand/collapse. This effect can also be magnified by very large portfolios. You can improve performance by reducing the number of columns being displayed, turning off notifications for daily gains (or filtering your History tab to show only recent history)